Do I Need To Be Vat Registered To Sell On Amazon

Introduction

The last thing an e-commerce shop owner would want to see is an electronic mail instructing him or her to open a VAT file with the HMRC for future Value Added Taxation (VAT) collection purposes. Even so, this is exactly the kind of e-mail many Amazon sellers received concluding year, and the requirement to open up a VAT file and collect VAT payments have baffled the bulk of e-commerce store owners listed on Amazon UK.

In full general, the introduction of VAT for Amazon sellers in the UK has resulted in an uproar in the online selling customs, just paying VAT is no longer an option, merely a mandatory requirement for all UK based due east-commerce sellers. In this light, this article takes a look at the VAT registration requirements for United kingdom based Amazon sellers in detail.

VAT registration requirements for Britain based Amazon sellers

Value Added Tax is charged on all orders sold by Amazon within the European Union, and for UK based sellers, the standard VAT rate calculation is applicable on all sales completed through Amazon. Withal, terminal VAT charge per unit applicable volition exist calculated based on the end destination of the products or services sold on Amazon UK.

The same VAT structure applicable for goods and services sold physically in the UK applies to goods and services sold on Amazon as well, and VAT is practical on all digital product sales every bit well, which include the below.

(Source – Amazon )

In essence, any east-commerce seller based in the Uk, whose almanac turnover exceeds £85,000 should open a VAT file immediately to avoid existence subject field to fines from the HMRC.

VAT registration requirements for non-UK based Amazon sellers

For many years, taxes charged on products sold by international sellers in the UK remained a grey area, and this opened doors for many international sellers to evade taxes including VAT. However, there are stricter rules in identify now, and the United kingdom Finance Beak 2018 made it mandatory for international sellers to open a VAT file with the HMRC to study VAT if concrete goods are stored in the Great britain for distribution.

International sellers who are using Amazon United kingdom of great britain and northern ireland to sell products and services to UK customers could be categorized into two segments.

- An international seller whose goods are stored in Britain at the betoken of sale

- An international seller who sells appurtenances to UK based customers

- An international seller based in a Eu fellow member state

It'due south important to distinguish between these three categories as the regulatory implications are dissimilar for each of these categories.

All international sellers whose goods are stored in UK at the betoken of sale, or sell appurtenances and services to U.k. based customers should open a VAT file immediately regardless of the value or volume of transactions. Therefore, all Chinese and other international sellers are required to open a VAT file every bit shortly as they make up one's mind to shop their goods in UK or sell a product or service to UK based customers. Amazon Great britain is not exempted from any of these rules and regulations, significant it is mandatory for international sellers to open a VAT file to behave any grade of business in the United Kingdom.

For Amazon sellers based in other EU member states, the regulatory environment is a fleck different from that of other international sellers. Substantially, a seller based in an Eu member land should register to pay VAT if sales to U.k. customers exceed £70,000 per annum, which is commonly referred to as the altitude selling threshold.

Amazon wants everyone to register for UK VAT regardless of minimum thresholds

As nosotros discussed in the previous segment, there is no demand for a pocket-size business to annals with the HMRC to pay VAT if the seller is UK based and the annual turnover is below £85,000. However, Amazon has been aggressively pushing all sellers to register for UK VAT regardless of the minimum thresholds imposed by the HMRC, and this has raised many questions among small business owners who are at a loss as to why Amazon is deploying such an ambitious strategy.

The respond can be easily plant past browsing through the latest laws enacted by the HMRC to hold online marketplaces liable to any revenue enhancement frauds committed by sellers listed on their marketplaces. From March 15, 2018, HMRC has been legally empowered to hold online marketplaces liable for such fraudulent activities, and the HMRC has published many guidelines to be followed by online marketplaces including Amazon.

These guidelines include but not limited to;

- Obtaining a VAT registration number from all sellers listed on Amazon UK who are supposed to pay VAT

- Validating the obtained VAT registration number

- Validating and verifying the location of the seller

- Determining and validating the destination of end products and services

All these guidelines should exist followed by Amazon, and this naturally makes the company vulnerable to taxation frauds carried out by overseas sellers or UK based sellers who operate with the intention of avoiding VAT payments to the authorities.

The failure to comply with these guidelines might consequence in significant penalties imposed on Amazon by the HMRC, and to avoid such hefty penalties, Amazon is taking a more safer simply ambitious measure by requesting all sellers listing their products and services on Amazon UK to register with the HMRC for VAT purposes.

What if you neglect to provide a valid VAT registration number to Amazon?

The failure to comply with instructions provided to sellers by Amazon might effect in the termination of such seller accounts, and Amazon has already done the necessary groundwork to expedite the VAT registration process of Amazon UK storeowners.

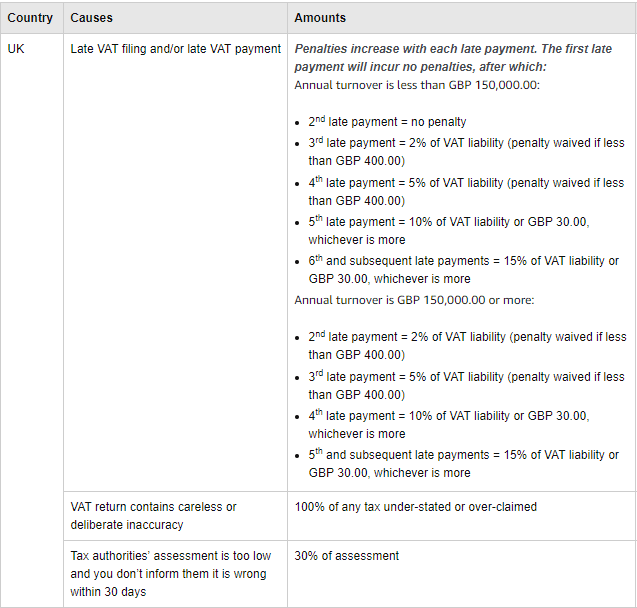

Below tabular array should provide Amazon UK sellers with an idea on the penalties and fines that could be imposed on them for failure to open a VAT file with the HMRC and/or failure to provide regulators with accurate information.

(Source – Amazon Seller Cardinal)

What is the progress made then far and the future outlook?

A recent Bloomberg report discussed how the HMRC has become a much more than powerful unit over the last couple of years, and how this has helped the regulators crack-down on unlawful sellers operating on billion dollar marketplaces including Amazon.

According to HMRC, VAT registrations have grown from 27,550 a year ago to over 58,000 at nowadays, which is proof of the recent success the regulators have had in getting online marketplaces to comply with applicable VAT rules.

In addition, the HMRC has already filed a number of cases against sellers who are accused of non complying with applicative rules despite several warnings.

Considering all bachelor information regarding the radical changes implemented so far past the HMRC and online marketplaces including Amazon, it tin can be ended that these changes are here to stay, and sellers should embrace these changes and adhere to regulatory requirements as soon as possible.

Do I Need To Be Vat Registered To Sell On Amazon,

Source: https://vatnumberuk.com/uk-vat-registration-for-amazon-sellers/

Posted by: harrodficul1984.blogspot.com

0 Response to "Do I Need To Be Vat Registered To Sell On Amazon"

Post a Comment